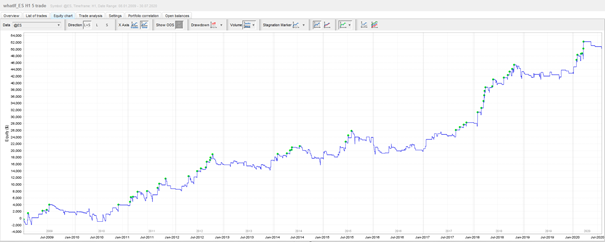

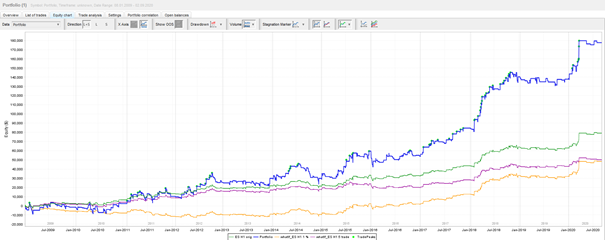

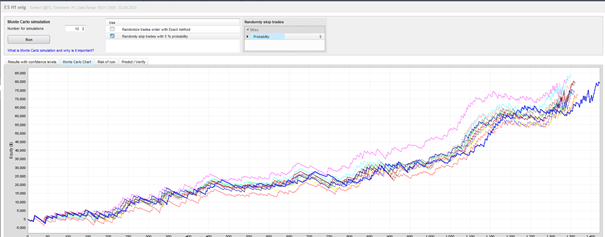

Back testing is a common practice in financial analysis, where analysts test trading strategies using historical data. While back testing can be a powerful tool for predicting future market trends and generating profits, it can also be prone to errors due to two key psychological biases: overfitting and confirmation bias.

Overfitting occurs when a trading strategy is designed and tested using historical data that is too specific and too limited. This can result in a strategy that is too closely tailored to the past and may not perform well in future market conditions. Confirmation bias, on the other hand, occurs when traders only look for evidence that supports their preconceived notions about the market, rather than seeking out contradictory evidence that could challenge their assumptions.

To avoid these psychological biases and make the most of back testing, here are some practical tips:

- Use diverse data: When back testing a trading strategy, it’s important to use a diverse range of historical data that includes a variety of market conditions. This can help prevent overfitting by ensuring that the strategy is designed to perform well in a range of different scenarios.

- Test multiple scenarios: To further prevent overfitting, it’s also important to test the trading strategy against multiple scenarios. This can help ensure that the strategy is robust and can perform well even in unexpected market conditions.

- Use out-of-sample testing: In addition to testing a trading strategy against historical data, it’s also important to use out-of-sample testing. This involves testing the strategy on data that was not included in the original back test, which can help reveal any potential weaknesses or flaws in the strategy.

- Challenge assumptions: To avoid confirmation bias, it’s important to challenge assumptions and seek out contradictory evidence. This can involve testing the strategy against different data sets, seeking out alternative perspectives, and looking for evidence that contradicts your initial assumptions.

- Avoid data snooping: Data snooping occurs when traders search through large data sets to find patterns that may not actually be significant. This can lead to overfitting and false conclusions. To avoid data snooping, it’s important to have a clear hypothesis and methodology in place before conducting any analysis, and to be transparent about the data sets and variables used.

By following these tips, you can avoid the psychological biases that can undermine the effectiveness of back testing, and make more informed decisions about their trading strategies. Ultimately, this can help improve your chances of generating profits and achieving long-term success in the financial markets.