Algo trading, also known as algorithmic trading, is a form of trading that uses computer algorithms to automatically generate trading signals and execute trades. Algo trading is used by many professional traders and investors to take advantage of market inefficiencies and to reduce the amount of time and effort required to make trading decisions.

Algo trading is based on the use of computer algorithms to identify trading opportunities and execute trades. These algorithms are programmed to analyze market data and identify patterns that may indicate a profitable trading opportunity. Once a trading opportunity is identified, the algorithm will automatically generate a trading signal and execute the trade.

Algo trading can be used to trade a variety of financial instruments, including stocks, futures, options, and currencies. It can also be used to trade a variety of strategies, such as trend following, mean reversion, and arbitrage.

Getting started with algo trading requires a basic understanding of the markets and trading strategies. It is also important to have a good understanding of the different types of algorithms available and how they work. Additionally, it is important to have access to reliable data sources and a reliable trading platform.

Once you have a basic understanding of the markets and trading strategies, you can begin to develop your own trading algorithms. This can be done by using a variety of programming languages, such as Python, C++, and Java. Additionally, there are a number of software packages available that can help you develop your own trading algorithms.

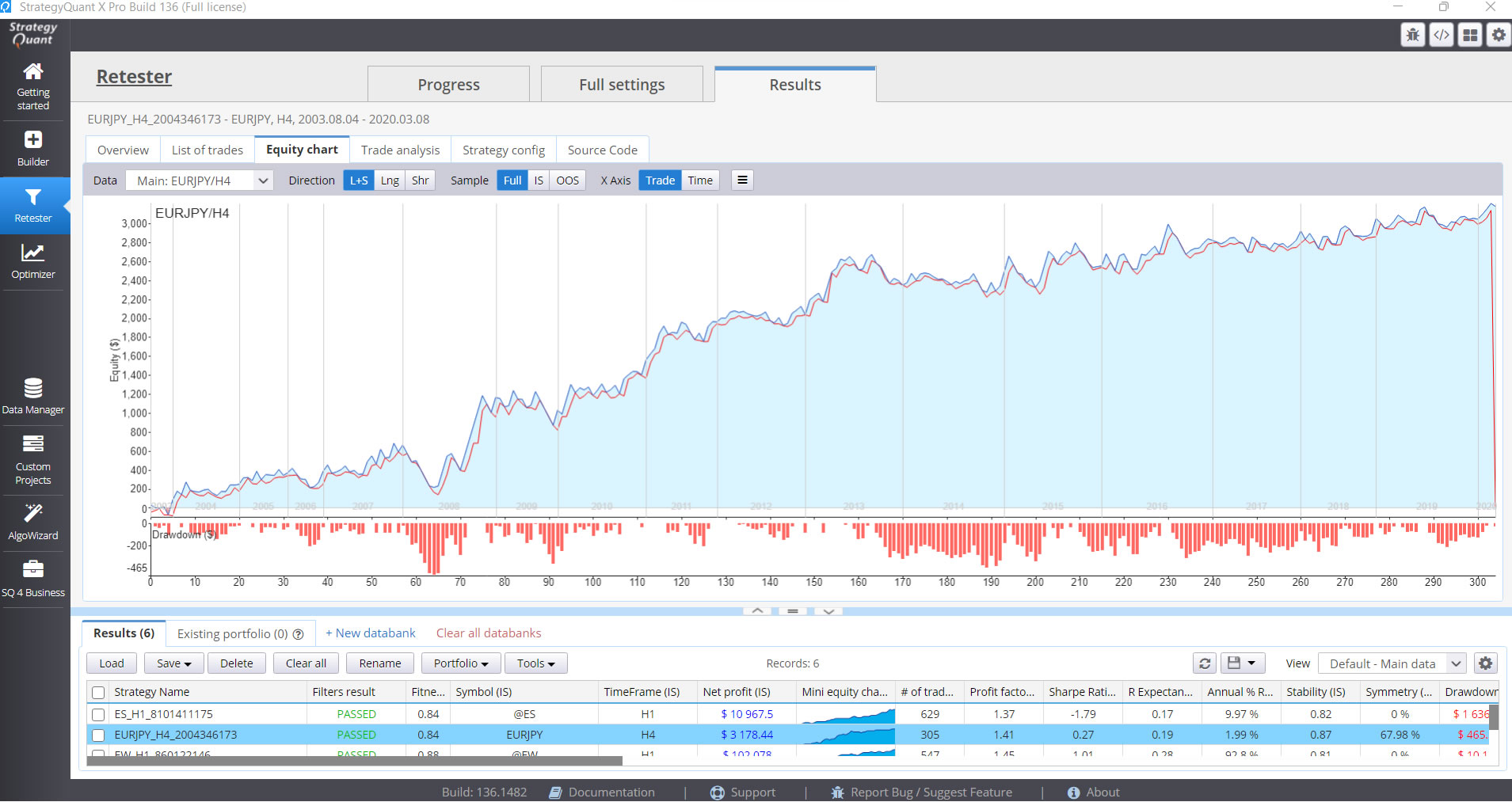

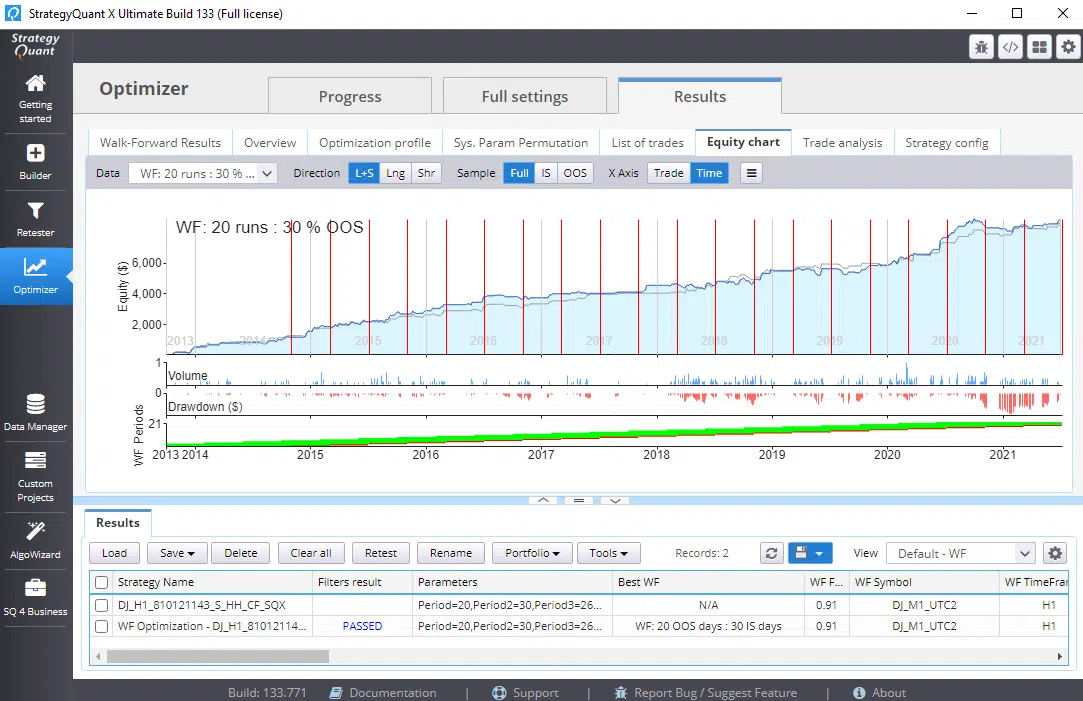

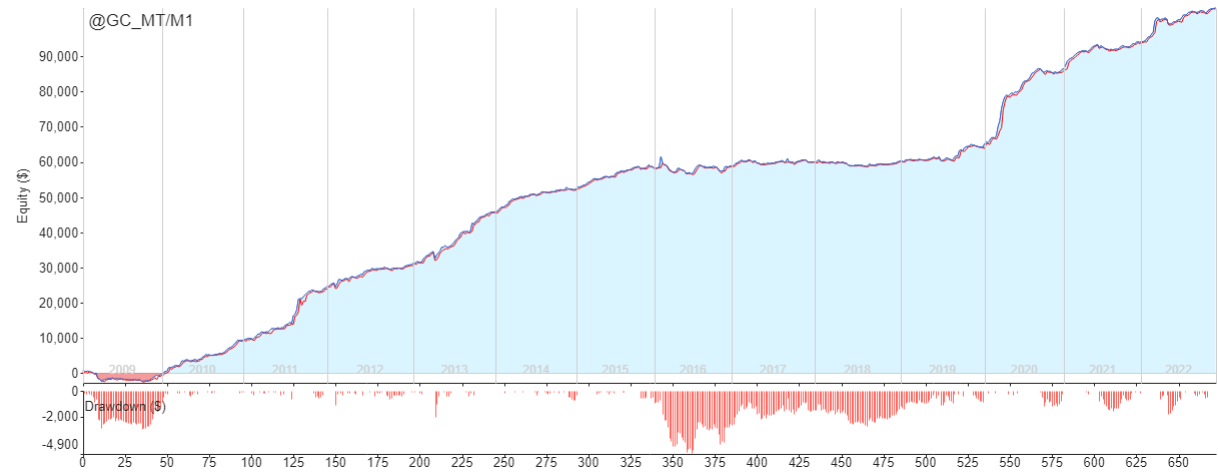

Once you have developed your own trading algorithms, you can then backtest them to see how they would have performed in the past. This will help you determine if your algorithms are profitable and if they are suitable for live trading.

Finally, you can begin to trade with your algorithms by connecting them to a broker or trading platform. This will allow you to execute trades automatically based on the signals generated by your algorithms.

Algo trading can be a powerful tool for traders and investors looking to take advantage of market inefficiencies and reduce the amount of time and effort required to make trading decisions. With the right knowledge and tools, anyone can get started with algo trading.

Understanding the Basics of Algo Trading Strategies

Algorithmic trading, also known as algo trading, is a form of trading that uses complex algorithms to make decisions about when to buy and sell financial instruments. Algo trading strategies are based on mathematical models that use historical data and market conditions to make decisions about when to enter and exit trades.

Algo trading strategies can be used to trade a variety of financial instruments, including stocks, futures, options, and currencies. These strategies are designed to take advantage of market inefficiencies and to reduce the risk associated with trading. Algo trading strategies can be used by both individual traders and institutional investors.

Algo trading strategies are based on a variety of factors, including market conditions, technical indicators, and risk management. Technical indicators are used to identify trends and patterns in the market, while risk management strategies are used to limit losses and maximize profits. Algo trading strategies can also be used to automate the trading process, allowing traders to focus on other aspects of their trading strategy.

Algo trading strategies can be divided into two main categories: trend-following strategies and mean-reversion strategies. Trend-following strategies are designed to take advantage of market trends, while mean-reversion strategies are designed to take advantage of market reversals.

Algo trading strategies can be used to trade a variety of financial instruments, including stocks, futures, options, and currencies. These strategies are designed to take advantage of market inefficiencies and to reduce the risk associated with trading. Algo trading strategies can be used by both individual traders and institutional investors.

Algo trading strategies can be complex and require a great deal of research and analysis. It is important to understand the basics of algo trading strategies before attempting to use them. It is also important to understand the risks associated with algo trading strategies and to ensure that the strategies are suitable for the trader’s risk profile.

Platform

Algo trading is a form of automated trading that uses computer algorithms to execute trades. It is becoming increasingly popular among traders, as it can help to reduce the time and effort required to make profitable trades. However, choosing the right algo trading platform can be a daunting task. Here are some tips to help you make the right choice.

1. Research the Platform: Before selecting an algo trading platform, it is important to do your research. Look for reviews from other traders and read up on the features and capabilities of the platform. Make sure that the platform is reliable and secure, and that it offers the features and tools you need.

2. Consider Your Trading Style: Different algo trading platforms offer different features and tools. Consider your trading style and the types of strategies you use when selecting a platform. Make sure that the platform offers the features and tools you need to execute your strategies.

3. Look for Low Fees: Algo trading platforms typically charge fees for their services. Look for a platform that offers low fees and competitive pricing.

4. Test the Platform: Most algo trading platforms offer a free trial period. Take advantage of this to test the platform and make sure it meets your needs.

By following these tips, you can make sure that you select the right algo trading platform for your needs. With the right platform, you can make more profitable trades and reduce the time and effort required to do so.

The Benefits of Automated Algo Trading

Algorithmic trading, or algo trading, is a form of automated trading that uses computer algorithms to determine when and how to trade financial instruments. Algo trading has become increasingly popular in recent years due to its ability to execute trades quickly and accurately, as well as its potential to reduce transaction costs. In this article, we will discuss the benefits of automated algo trading.

First, algo trading can help traders make more informed decisions. By using algorithms to analyze market data, algo trading can identify patterns and trends that may not be visible to the human eye. This can help traders make more informed decisions about when to enter and exit trades.

Second, algo trading can help traders reduce transaction costs. By using algorithms to execute trades, traders can avoid the costs associated with manual trading, such as commissions and fees. Algo trading can also help traders reduce the risk of making mistakes due to human error.

Third, algo trading can help traders take advantage of market opportunities. By using algorithms to identify and execute trades, traders can take advantage of market opportunities that may not be available to manual traders. This can help traders maximize their profits.

Finally, algo trading can help traders manage their risk. By using algorithms to analyze market data, algo trading can help traders identify and manage risk. This can help traders reduce their exposure to risk and maximize their returns.

In conclusion, automated algo trading can provide many benefits to traders. By using algorithms to analyze market data, algo trading can help traders make more informed decisions, reduce transaction costs, take advantage of market opportunities, and manage their risk. As such, algo trading can be a valuable tool for traders looking to maximize their profits.

Tips for Developing Your Own Algo Trading Strategies

1. Start with a basic strategy: Before you start developing your own algo trading strategies, it is important to start with a basic strategy. This will help you understand the basics of algo trading and how it works.

2. Research the markets: Before you start developing your own algo trading strategies, it is important to research the markets. This will help you understand the different market conditions and how they affect your trading strategies.

3. Test your strategies: Once you have developed your own algo trading strategies, it is important to test them. This will help you identify any potential flaws in your strategies and make adjustments accordingly.

4. Monitor your strategies: Once you have developed and tested your algo trading strategies, it is important to monitor them. This will help you identify any changes in the markets that could affect your strategies and make adjustments accordingly.

5. Backtest your strategies: Backtesting your strategies is an important step in developing your own algo trading strategies. This will help you identify any potential flaws in your strategies and make adjustments accordingly.

6. Automate your strategies: Once you have developed and tested your algo trading strategies, it is important to automate them. This will help you save time and effort in managing your strategies and make sure that they are running smoothly.

7. Monitor your performance: Once you have automated your algo trading strategies, it is important to monitor your performance. This will help you identify any potential flaws in your strategies and make adjustments accordingly.