When it comes to trading Contract for Difference (CFD), understanding the intricacies of the market is essential for success. One of the most important aspects of CFD trading is understanding the point value, tick pip step and size. In this article, we’ll explore these concepts, how to set them and provide recommendations for finding these values.

What are Point Value, Tick Pip Step, and Size?

Point Value: Represents the monetary value of one pip in the base currency of a CFD.

Tick Pip Step: Refers to the minimum price change of the underlying asset that a CFD can move in, expressed in pips.

Tick Pip Size: Represents the monetary value of one point in the base currency of the trading account, used to calculate potential profit or loss.

How to identify correct values in MT4/5?

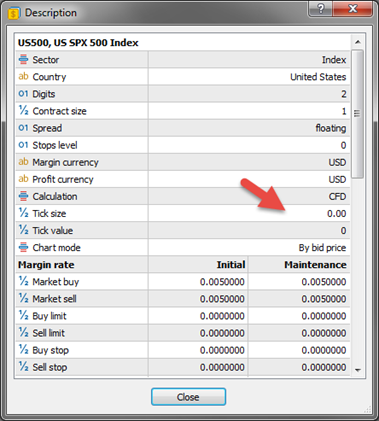

First, you need to take a look at the chart for how many digits the instrument quoted.

You can see that this ticker is quoted for one digit.

- Now you can see the contract size, which is the point value in SQ X, and it represents the monetary value for one pip.

- In the next step, you need to set the tick pip step and size correctly. Tick size represents the value for one pip. Additionally, you will find the tick pip step, which represents the smallest incremental movement for one pip.

Please note that the instrument setting is not always accurate, and sometimes the broker may not even display the point value correctly. You may need to experiment with it a little bit to ensure accuracy.

It is highly recommended that the results be verified on the broker platform using a well-chosen strategy, ensuring that the backtest aligns seamlessly with SQX. In doing so, a greater sense of confidence and success will undoubtedly be achieved in your trading endeavors.

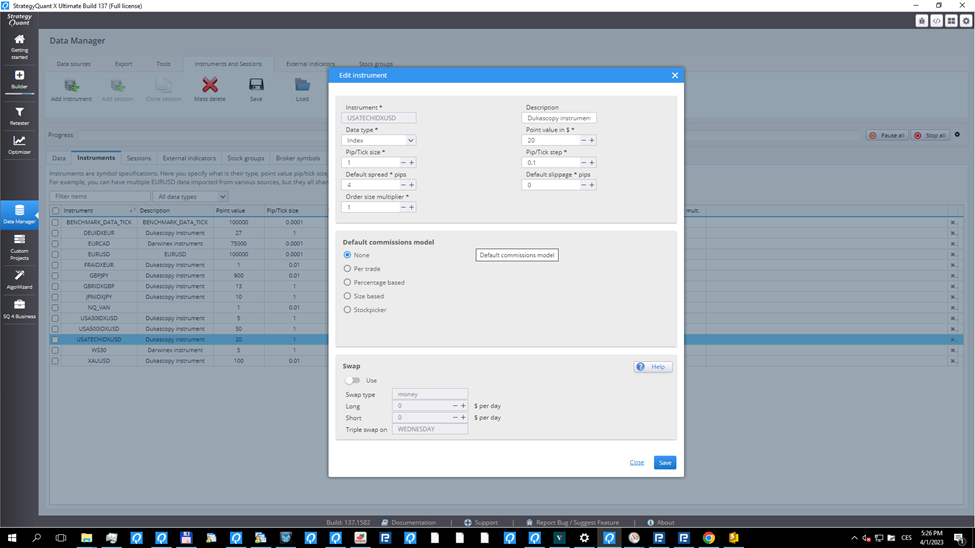

Setting Point Value, Tick Pip Step, and Size for CFDs in StrategyQuant

The instrument settings can effortlessly be edited in the data manager tab, empowering you to customize and optimize your trading experience with ease and precision.

Important note: Always, verify the results in the broker platform with some strategy and make sure that backtest matches with SQX.

Please, note that the point value in SQ X is calculated in USD so if some instrument is calculated in another currency for example AUD you need to convert the value to USD otherwise the results will be in the original currency

Examples of settings for Nasdaq CFD

IC Markets

Point value 1

Tick pip size 0.01

Tick pip step 0.01

Darwinex

Point value 20

Tick pip size 1

Tick pip step 0.1

Pepperstone

Point value 20

Tick pip size 1

Tick pip step 0.1

Dukascopy

Point value 1

Tick pip size 0.01

Tick pip step 0.01

F.A.Q.

Can I use the strategy developed on IC Markets with other Brokers?

The answer is yes and no. The problem with CFDs is that every broker can use their own settings of tick pip step/size and point value. So our recommendation is to always do the backtest on the target broker where you want to trade. If the backtest does not match the original, our recommendation is to build a new strategy.

Can I use the strategy developed for Futures data on CFDs?

No, the value of the tick pip step/size and point value is different, so the backtest in the platform will not match with the CFD broker.